38 step up coupon bonds

Half of sustainability-linked bond issuers see greenium ... A coupon step-up of 25bp remained the standard, according to the report, with 45% of issuers committing to pay up a quarter of a percent if they missed their sustainability targets. The second most common step-ups were 12.5bp at 23% and 50bp at 11%. Deroux said that a 25bp step up "seems insufficient". High-Yield Bonds: Looking Under the Hood - Janus Henderson ... Meanwhile covenant quality (the terms attached to debt such as a step up in coupon paid on a bond if a company breaches certain financial metrics) has deteriorated. This often happens when bond issuers and investors are more confident but we need to be careful that yields and terms reflect a reasonable balance against risks, hence why rigorous ...

Deferred-Coupon Bond - Fincyclopedia This bond combines the features of standard bonds, step-up bonds, and zero-coupon bonds. For example, a 10-year bond may have a provision that coupon interest must start five years from the date of issuance. In other words, this bond has a zero-coupon for the first five years, and then a specific coupon (say 8%) for the remaining five years.

Step up coupon bonds

Step-Up CDs: What They Are And How They Work | Bankrate U.S. Bank, for instance, offers a 28-month step-up CD. The interest rate tied to the CD increases every seven months, moving from 0.05 percent to 0.25 percent to 0.45 percent to 0.65 percent. But... All the 21 Types of Bonds | General Features and Valuation ... The step-up bonds are where the coupon usually steps up after a certain period. They may also be designed to step up not once but in a series. Such bonds are usually issued by companies where revenues/ profits are expected to grow in a phased manner. These are also called dual coupon or multiple coupon bonds. Step Down Bonds What Is an Agency Bond? Step-up notes have a coupon rate that increases or "steps up" over time, according to a predetermined schedule. Advantages and Disadvantages of Agency Bonds Investing in agency bonds can offer some unique benefits to investors, starting with the potential to generate higher yields than other Treasury securities .

Step up coupon bonds. Who Pays for Sustainability? An Analysis of Sustainability ... Our analysis suggests that the sustainability premium is larger for bonds with a higher coupon step-up and for callable bonds. We also show that there is a 'free lunch' for some SLB issuers, as their financial savings are higher than the potential penalty, and they have a call option to reduce this penalty. Dual Coupon Bond - Fincyclopedia Typically, issuers embed dual-coupon bonds with call options which give them the right to redeem the bonds at par on the date the coupon is set to step up. This bond is also known as a stepped coupon bond, a rising-coupon bond, or a step-up coupon bond. D 206 Bond, Coupon Bond, Dual Coupon Bond, Finance, Financial Previous Dual Currency Option Bond Sustainability-linked bonds in 'rapid growth' as more ... While investors are becoming more familiar with sustainability-linked bonds, there is still some skepticism, in particular over the so-called coupon step-up, which imposes a penalty on the issuer if it fails to reach its target. Agency Bonds: Limited Risk And Higher Return Somewhat common is a step-up structure, in which the coupon rises as the bond approaches maturity. Step-ups are often attached to callable bonds, making them more likely to be called as the coupon...

Fast food franchisee eyes SLBs for rapid emissions reduction The firm is also offering to repurchase up to $150m of the $525.9m outstanding on its 5.875% 2027 notes. Investors that tender their bonds before 5pm on April 29 will receive an additional 30 cent... Agea SLB succeeds in tough market If missed, there will be a 15bp step-up in the coupon. Target two aims to increase the proportion of leadership positions filled by women to at least 38% by 2025. The third target aims to increase... Russia Bans Coupon Payment to Foreigners on $29 Billion in ... The Russian central bank has banned coupon payments to foreign owners of ruble bonds known as OFZs in what it called a temporary step to shore up markets in the wake of international sanctions. Step-Up Bonds | Meaning, Single, Multiple, Callable Bonds ... Step-up bonds or step-up notes are securities with a coupon rate that increases over time. These securities are called step-up bonds because the coupon rate "steps up" over time. For example, the step-up bond could have a 5% coupon rate for the first two years, 5.5% for the third and fourth years, and 6% for the fifth year.

Quant Bonds - Coupons - BetterSolutions.com The coupon (or coupon rate) is the annual interest rate that is paid by this bond. Bonds pay interest in arrears This interest rate is fixed when the bond is issued. Coupons are generally fixed in even multiples of (1/8 percent) The interest on a bond is always GROSS Fixed Coupons Also known as Fixed Rate Coupon Bonds. Enbridge captures 'Greenium' with SLB debut - JWN Energy Enbridge's 2033 sustainability-linked bond coupon will have a step-up of 50 basis points if the firm doesn't comply with a target to reduce its carbon emissions by the end of 2030, said people familiar with the matter, who asked not to be identified because details are private. Protecting investors from interest-rate risk with step-up ... Step-up bonds are special types of bonds that offer a lower interest rate at the beginning with a provision for an interest rate increase after a certain period. The number and level of the rate increase, as well as the timing, depends on the bond terms. The step-up bonds may have a single interest rate rise or multiple interest rate rises. Analysis: Sustainability-linked bonds face big reputation ... The European Banking Authority has said bonds with step-ups would not be suitable as capital products for commercial banks because the coupon could increase, thereby eroding an institution's capital base. This has hampered issuance from the financial sector, which has been a large issuer of green bonds.

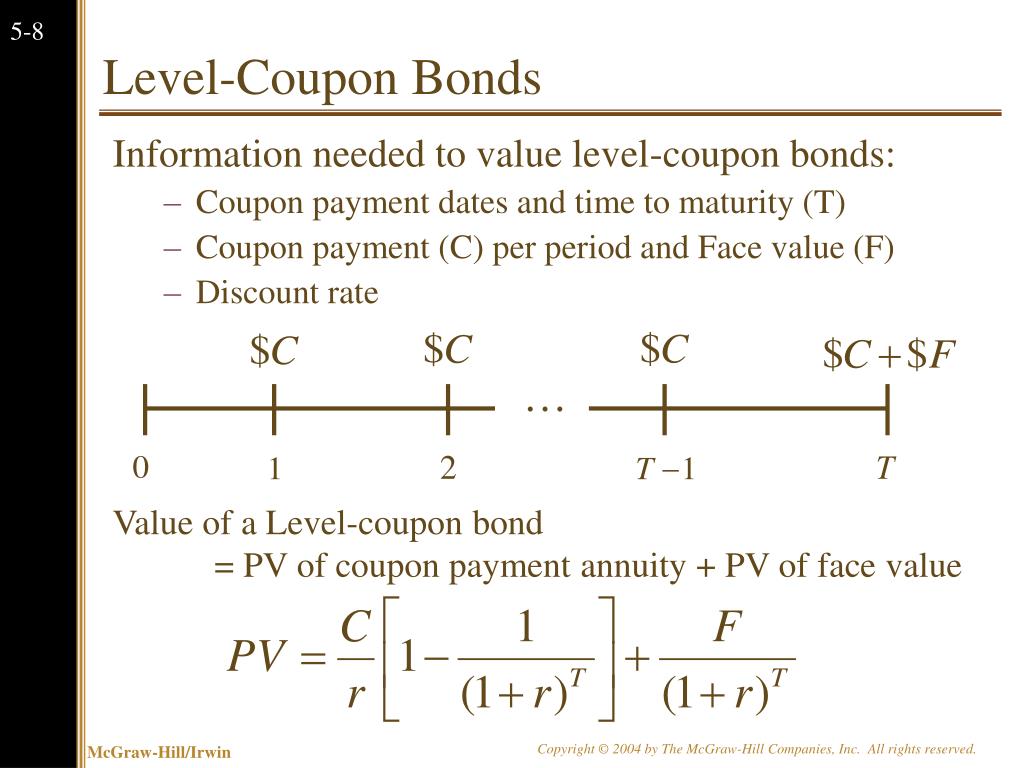

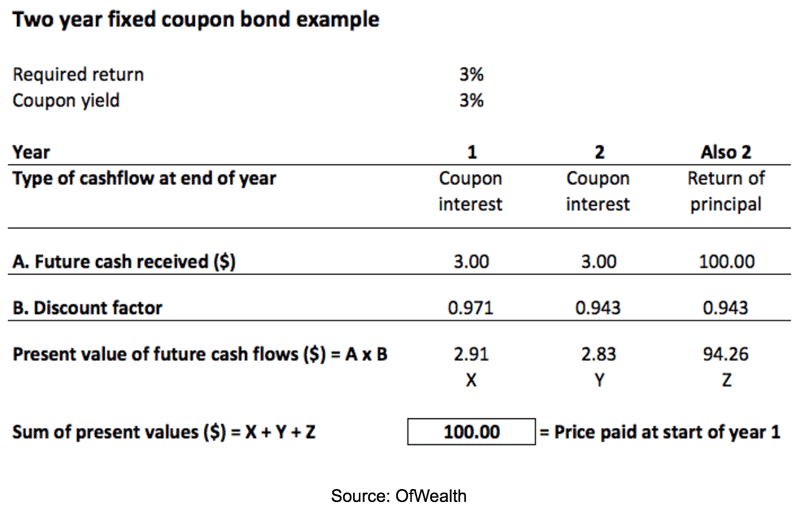

Basics Of Bonds - Maturity, Coupons And Yield To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). The current yield has changed. Divide 4.5 by the new price, 101.

Analysis: Sri Lanka bondholders brace for big losses in ... Step-up coupons - interest payments that increase over time - could also play a role "to give the government more time to recover" after the restructuring, Guarino added, noting these were used in...

What Is a Perpetual Bond? A perpetual bond is a rare type of bond that offers regular interest payments indefinitely but doesn't have a maturity date. 1. A bond is a loan investors make to a corporation, the federal government, a government agency, or a municipality. Most bonds offer investors regular fixed interest payments called " coupons " throughout the bond ...

Assessing ESG Bond Structures | Bernstein Typically, failure to achieve the KPIs by a given milestone date results in a step-up in the bonds' coupon. In this way, disappointed investors will receive increased interest payments in lieu of the promised ESG improvements. But there will be no real incentive for the issuer to perform if the penalty is too small and/or the milestone date ...

Difference Between Coupon Rate and Interest Rate (With ... Firstly, it is the zero-coupon bonds. They don't have any coupon payment for the bondholder to pay for. Also, it is affordable by the holder at a price lesser than the original par value of the bond. Secondly, Step-Up notes, unlike the true definition of a coupon rate, tend to increase the rate at a set period.

Step-Up Bond - Definition, Understanding, and Why Step-Up ... A step-up bond is a security that has a coupon rate which increases with time. A step-up bond typically performs better than any other fixed-rate investment in a rising rate market. The Securities and Exchange Commission (SEC) regulates the step-up bonds.

Raymond James Financial | Services and Products | Bond Basics | Types of Income | Step-Up Bonds

An Overview of Perpetual Bonds - Investopedia As an example, a bond with a $100 par value, paying a coupon rate of 5%, and trading at the discounted price of $95.92 would have a current yield of 5.21%. Thus the calculation would be as follows:...

Bonds - SCOR Bonds Bonds. SCOR's current debt structure. Social Block. Share. Body Debt: Original amount issued. Current. Amount. Outstanding (Book Value) Issue. date. Maturity: Floating / Fixed rate. Coupon ... (no step-up) 13/03/2029 ...

Step Up Notes Offer Higher Yields Than Cash According to Investopedia, "A Step-up Bond pays an initial coupon rate for the first period, and then a higher coupon rate for the following periods. For example a five year bond may pay a 4% coupon for the first two years of its life and a 6% coupon for the next three years" (Of course, not in this interest rate environment) :).

NextEra Energy introduces coupon step-up on green bond | IFR US company NextEra Energy Capital Holdings (Baa1/BBB+/A-) included a "green non-certification event" on its recent seven-year US$1.5bn green bond that introduces a coupon step-up if the company fails to produce an allocation and impact report within a specified time to address investors' concerns about transparency.

What Is an Agency Bond? Step-up notes have a coupon rate that increases or "steps up" over time, according to a predetermined schedule. Advantages and Disadvantages of Agency Bonds Investing in agency bonds can offer some unique benefits to investors, starting with the potential to generate higher yields than other Treasury securities .

All the 21 Types of Bonds | General Features and Valuation ... The step-up bonds are where the coupon usually steps up after a certain period. They may also be designed to step up not once but in a series. Such bonds are usually issued by companies where revenues/ profits are expected to grow in a phased manner. These are also called dual coupon or multiple coupon bonds. Step Down Bonds

Step-Up CDs: What They Are And How They Work | Bankrate U.S. Bank, for instance, offers a 28-month step-up CD. The interest rate tied to the CD increases every seven months, moving from 0.05 percent to 0.25 percent to 0.45 percent to 0.65 percent. But...

Post a Comment for "38 step up coupon bonds"