42 coupon interest rate definition

interest rate swap - What does it mean for a coupon bond to have "par ... Sloppy English + no editor. The lemma really says that if you calculate the fair value of an instrument (FRN, or a floating leg of an interest rate swap..) that pays LIBOR (no spread added to it) by projecting the floating coupon cash flows using swap curve and discounting all the cash flows (coupons and principal) using the same curve, then this fair value is equal to the undiscounted face ... Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower.

Coupon Rate | Definition | Finance Strategists A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually ...

Coupon interest rate definition

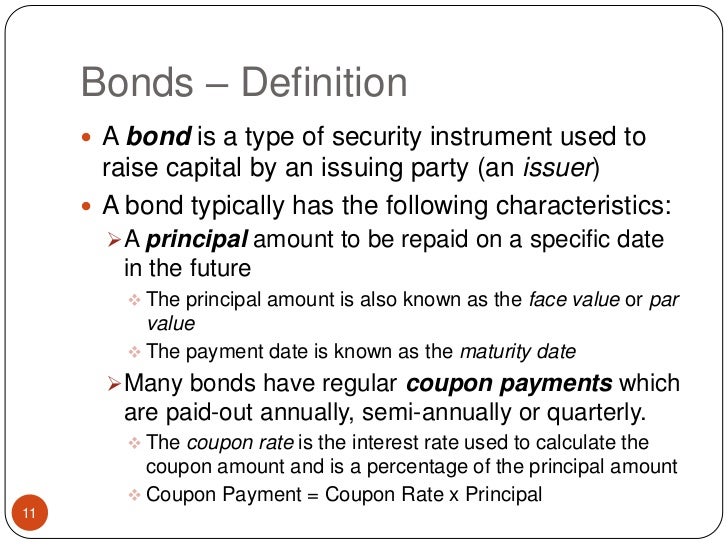

Difference Between Coupon Rate and Interest Rate Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending. • Coupon rate is decided by the issuer of the securities. Interest rate is decided by the lender. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... Coupon Rate: Formula and Bond Nominal Yield Calculator The coupon rate, or "nominal yield," is the rate of interest paid to a bondholder by the issuer of the debt. The coupon rate on a bond issuance is used to calculate the dollar amount of coupon payments paid, i.e. the periodic interest payments by the issuer to bondholders.

Coupon interest rate definition. Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) What is Coupon Rate? The coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is the rate of interest being paid off for the fixed income security such as bonds. Swap Rate (Definition,Types) | Interest Rate & Currency Swap ... Swap Rate Definition. A swap rate is a rate, the receiver demands in exchange for the variable LIBOR or MIBOR rate after a specified period and hence it is the fixed leg of an interest rate swap and such rate gives the receiver base for considering profit or loss from a swap. What Is Coupon Interest Why Interest Rate - Riclix Coupon Rate or coupon rate is the interest received when investing in fixed income securities; Interest is usually paid monthly or annually by the issuer based on the face value of the bond. The interest rate changes as the bond changes, commonly known as the rate of return or yield to maturity. Is coupon rate same as interest rate? - FindAnyAnswer.com Definition of 'Coupon Rate' Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. The bond issuer pays the interest annually until maturity, and after that returns the principal amount (or face value) also. Coupon rate is not the same as the rate of interest. Also question is, what is the difference ...

Coupon rate definition - AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ... What is coupon rate | Definition and Meaning - Capital.com The coupon payment on a bond is the interest payment received by the holder of the bond until the bond matures. Coupon rate formula. The coupon rate ... Junior Coupon Rate Schedule Definition | Law Insider Examples of Junior Coupon Rate Schedule in a sentence. Interest payments ("Junior Coupon Payments", and together with the Senior Coupon Payments, the "Coupon Payments") to the holders of the Junior Notes will (excluding the Junior Note Additional Interest referred to below) accrue on each Junior Note on a pro rata basis at the percentage rate per annum of the Junior Notional Amount applicable ...

Interest rate derivative - Wikipedia In finance, an interest rate derivative (IRD) is a derivative whose payments are determined through calculation techniques where the underlying benchmark product is an interest rate, or set of different interest rates. There are a multitude of different interest rate indices that can be used in this definition. What Is a Certificate of Deposit Coupon? | Pocketsense A coupon is the stated rate of interest on the certificate of deposit. The term comes from bonds that have coupons that must be torn off the original bond and redeemed to be paid the interest due. The interest rate specified by the coupon is paid at set intervals. Zero-Coupon Certificates of Deposit Learn About Coupon Interest Rates | Chegg.com The coupon interest rate indicates the annual interest rate paid by the issuer of the bond, taking into consideration its face value. The coupon interest rate is visualized in percentage form. The coupon rate is calculated by dividing annual coupon payments with the face value of the bond. Coupon interest rate - Financial Dictionary coupon interest rate the INTEREST RATE payable on the face value of a BOND. For example, a £100 bond with a 5% coupon rate of interest would generate a nominal return of £5 per year. See EFFECTIVE INTEREST RATE. Collins Dictionary of Economics, 4th ed. © C. Pass, B. Lowes, L. Davies 2005 Want to thank TFD for its existence?

Difference Between Coupon Rate and Interest Rate The coupon rate is normally used in the bonds, which is an income to the holder after paying the rate on certain purchased items. Interest rate is a reduction to the borrower by paying back the amount he/she has borrowed. The coupon Rate ends according to the maturity period mentioned by the bondholder while issuing the bond.

Coupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Coupon Definition & Meaning - Merriam-Webster The meaning of COUPON is a statement of due interest to be cut from a bearer bond when payable and presented for payment; also : the interest rate of a coupon. How to use coupon in a sentence.

Coupon Interest Rate: What is Coupon Interest Rate? Fixed Income ... What is Coupon Interest Rate? The Interest to be annually paid by the issuer of a bond as a percent of per value, which is specifi

Coupon Rate Calculator | Bond Coupon A coupon is the interest payment of a bond. Typically, it is distributed annually or semi-annually depending on the bond. We usually calculate it as the product of the coupon rate and the face value of the bond. How often do I receive coupons from investing in bonds? The short answer is it depends on the bonds that you invest in.

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Value_Interest_Rate_Swaps_Sep_2020-01-4b6f55263e5a41b091bded09d63da811.jpg)

Post a Comment for "42 coupon interest rate definition"