42 advantage of zero coupon bonds

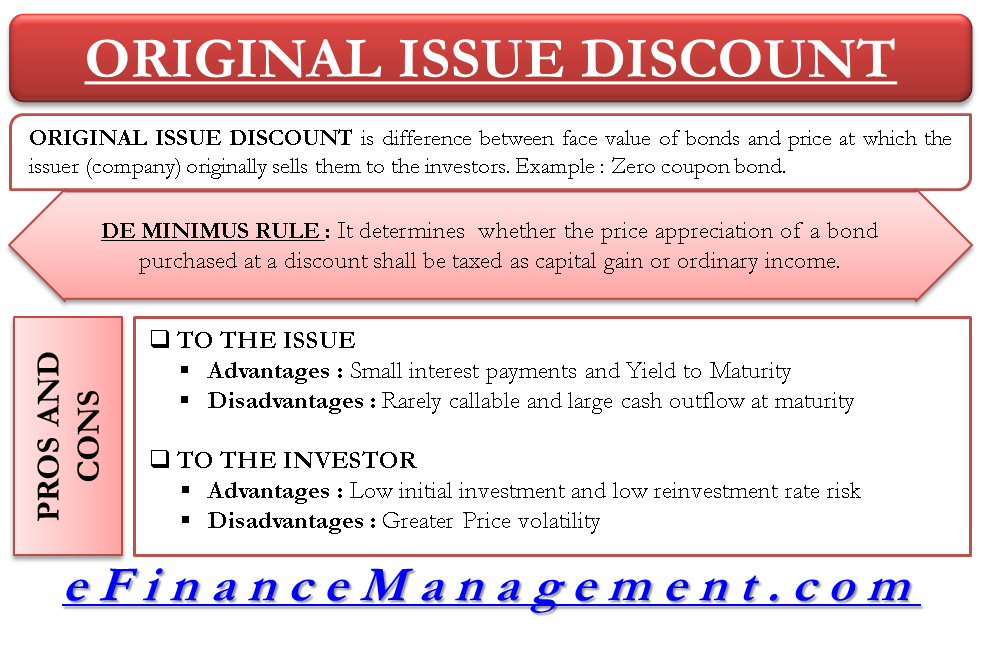

The best advantage of a zero-coupon bond to the issuer is that the ... The best advantage of a zero-coupon bond to the issuer is that the. Bond requires a low issuance cost. Bond requires no interest income calculation to the holder or issuer until maturity. Interest can be amortized annually by the APR method and need not be shown as an interest expense to the issuer. Interest can be amortized annually on a ... Zero-Coupon Bonds - Tax Professionals Member Article By Carmen Garcia A zero-coupon bond is a type of bond that earns no interest during its lifetime. A zero-coupon bond is issued with a sudden reduction in par value or face value, which is the amount that will be paid for the bond at maturity. An investor receives a one-time interest payment at maturity equal to the difference between the face value and the ...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Advantages, #1 - Predictability of Returns, This offers predetermined returns if held till maturity, which makes them a desirable choice among investors with long term goals or for those intending assured returns and doesn't intend to handle any type of Volatility usually associated with other types of Financial Instruments such as Equities, etc.

Advantage of zero coupon bonds

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity. What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds, They often have higher interest rates than other bonds, Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Advantage of zero coupon bonds. Zero coupon bonds what are the advantages and - Course Hero ANSWER: From the perspective of the issuing firm, low or zero coupon bonds have the advantage of requiring low or no cash outflow during the life of the bond. The issuing firm is allowed to deduct the amortized discount as interest expense for federal income tax purposes, which adds to the firm's cash flow. Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink The term "Zero Coupon Bond" has been defined by Section-2(48) of the Income Tax Act as below: - ... Further, the most important advantage of the zero coupon bonds is that no tax is payable on interest element if you invest in notified zero coupon bonds. These are subject to capital gains tax only. What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments and have a lower element of risk involved. Long Dated zero coupon bonds are the most responsive to interest rate fluctuations. Therefore, it might be profitable for the bondholder in the case of a long duration (a higher 'N'). Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Zero-Coupon Bonds facilitates the reliable source for fixed returns provided you keep our investment until maturity. A fixed return can be earned without worrying of the market chaos. No Reinvestment Risks, Zero-Coupon Bonds helps you avoid reinvestment risks. With Zero-Coupon Bonds there is no periodic coupon payment.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org zero-coupon bond on, the secondary market, will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. Learn About Zero Coupon Bond | Chegg.com A zero-coupon bond is a debt security that sells without an expressed coupon rate. These bonds are sold at deep discounts and do not pay monthly interest as typical bonds do.This way, the bond issuer does not need to worry about interest rate changes, and the investors receive a lump sum amount at maturity rather than regular coupon interest.. Bond issuers give out bonds to finance their long ... › government-bondsGovernment Bonds: Types, Benefits & How to Buy ... - BondsIndia Zero Coupon Bonds As the name suggests, Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. These bonds are created from existing securities rather than issuing them through auction. What are the advantages and disadvantages of zero-coupon bond? Originally Answered: What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival.

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year. Pros and Cons of Zero-Coupon Bonds | Kiplinger Their big advantage is that you know how much you'll collect a certain number of years from now. In mid June, for example, you could have bought a U.S. Treasury zero for $341 that matures in August... Zero coupon bonds what are the advantages and - Course Hero Low- and zero-coupon corporate bonds are purchased mainly for tax-exempt investment accounts (such as pension funds and individual retirement accounts).Chapter 7: Bond MarketsWEBTo the issuing firm, these bonds have the advantage of requiring low or no cash outflowduring their life. Additionally, the firm is permitted to deduct the amortized ... en.wikipedia.org › wiki › Warrant_(finance)Warrant (finance) - Wikipedia This warrant is company-issued. Suppose, a mutual fund that holds shares of the company sells warrants against those shares, also exercisable at $500 per share. These are called third-party warrants. The primary advantage is that the instrument helps in the price discovery process. In the above case, the mutual fund selling a one-year warrant ...

The Pros and Cons of Zero-Coupon Bonds - m.finweb.com Here are some of the pros and cons of investing in zero-coupon bonds. Pros, One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates.

A zero-coupon bond is a discounted investment that can help you save ... Advantages of zero-coupon bonds They often have higher interest rates than other bonds. Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them ...

› calcs › bondsBond Yield to Maturity Calculator for Comparing Bonds Instead, it is sold at a considerable discount to its par value. For example, a $1000 bond might be traded on the open market at a cost of $600, to be paid in full after 10 years. Quite often, standard issue bonds will be stripped of their coupons and sold on the public market as zero coupon bonds.

› terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

› fixed-income-bonds › individualCorporate Bonds - Fidelity Zero-coupon Zero-coupon corporate bonds are issued at a discount from face value (par), with the full value, including imputed interest, paid at maturity. Interest is taxable, even though no actual payments are made. Prices of zero-coupon bonds tend to be more volatile than bonds that make regular interest payments. Callable and puttable

Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds come with several benefits. The biggest is the predictability of returns. If an investor does not sell the bond prior to maturity, he/she does not have to worry about market fluctuations since the future value of the investment is known. How do you make money with a zero-coupon bond?

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more.

Zero-Coupon Bond - an overview | ScienceDirect Topics Zero-coupon bonds linked to the inflation do not pay coupons. Therefore, the unique adjustment is made to the principal. These types of bonds offer no reinvestment risk due to the absence of coupon payments and have the longest duration than other inflation-linked bonds. The value is given by Equation (6.8): (6.8)

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

Should I Invest in Zero Coupon Bonds? | The Motley Fool So, for instance, if you spent $750 on a 10-year $1,000 zero coupon bond, then the fact that the bond was priced to yield around 3% would mean that you'd have to pay tax on 3% of its value each ...

› article › understanding-bondsUnderstanding Bonds: The Types & Risks of Bond Investments Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and the investor then receives the full face value of the bond at maturity. All bonds carry some degree of "credit risk," or the risk that the bond issuer may default on one or more payments before the bond reaches maturity.

What is a Zero Coupon Bond? Who Should Invest? | Scripbox Following are the advantages of zero coupon bonds, Significant returns on maturity, These bonds are deep discount bonds that offer significant returns on maturity. Additionally, a bondholder can exit the bond by selling in the secondary market (stock market), in case the interest rates decline sharply. Fixed interest,

What Is a Zero Coupon Bond? | The Motley Fool Over the 10 years, and you will collect a total of $30 in interest, plus, at the end of the term, the company pays you back your initial $100 investment. In contrast, with a zero coupon bond with ...

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Attainment of Long Term Financial Goals: A zero-coupon bond is a suitable option for the investors aiming at the fulfilment of long term (more than ten years) objectives such as child's education, marriage, post-retirement goals, etc.

What is Zero Coupon Bond? - Groww Advantages of Zero-Coupon Bonds. It is important to understand the advantages of a Zero Coupon bond before opting for this investment. The advantages are mentioned below: No reinvestment risk: Other coupon bonds don't allow investors to a bond's cash flow at the same rate as the investment's required rate of returns. But the Zero Coupon ...

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds, As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds, They often have higher interest rates than other bonds, Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them...

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity.

/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

Post a Comment for "42 advantage of zero coupon bonds"