41 formula for coupon rate

Interest Expense: Formula & How to Calculate | The Motley Fool The simplest way to calculate interest expense is to multiply a company's total debt by the average interest rate on its debts. The Motley Fool If a company has $100 million in debt with an average... Yield to Call Calculator | Calculating YTC | InvestingAnswers To calculate a bond's yield to call, you'll need to know the: face value (also known as "par value") coupon rate number of years to the call date frequency of payments call premium (if any) current price of the bond Calculating Yield to Call Example For example, you buy a bond with a $1,000 face value and an 8% coupon for $900.

Why Senators Are Fighting to Help You to Buy More I Bonds Soon I Bonds are issued by the U.S. Government. They carry a zero-coupon interest rate which is adjusted twice annually for inflation. The rate will be 9.62% through October 2022, at which point it...

Formula for coupon rate

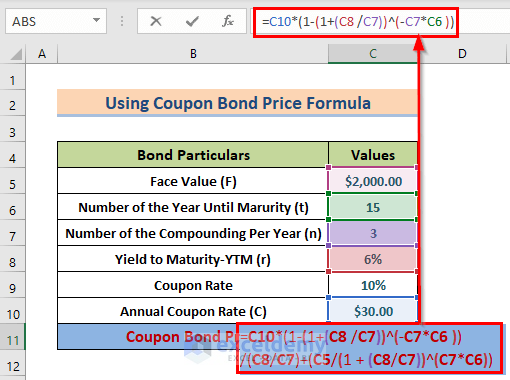

› coupon-bond-formulaCoupon Bond Formula | How to Calculate the Price of Coupon Bond? It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more. Example #2. Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 ... 91 Day T Bill Treasury Rate - Bankrate Year ago. 91-day T-bill auction avg disc rate. 3.34. 2.88. 0.04. What it means: The U.S. government issues short-term debt at a discount at a competitive auction, usually on a weekly basis. At a ... Fluxactive Complete Reviews - Don't Buy Until You Read This! The formula of Fluxactive Complete helps you hold your bladder and prevents you from waking up in the middle of the night to urinate. It increases your sexual drive, energy, and stamina. Fluxactive Complete can let you enjoy sex like a man. The supplement is free from GMOs, harmful additives, and other habit-forming synthetics.

Formula for coupon rate. South Africa Government Bonds - Yields Curve The South Africa 10Y Government Bond has a 10.660% yield.. 10 Years vs 2 Years bond spread is 349 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 6.25% (last modification in September 2022).. The South Africa credit rating is BB-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 313.76 and implied probability of default ... Credit Suisse X-Links Crude Oil Shares Covered Call ETNs - MarketBeat 7 Stocks to Buy to Outrun Rising Interest Rates; 7 Mid-Cap Stocks That Can be the Perfect Fit at Any Time; 7 Blue-Chip Dividend Stocks That Won't be Impacted by Rising Interest Rates; 7 Stocks with the Pricing Power to Push Through High Inflation; 10 Recession-Proof Stocks That Will Let You Wait Out the Bear; News. Real-Time News Feed ... Best Store Credit Cards for October 2022 - CNET For each eligible purchase you make in gas or dining merchant categories, you earn rewards at a rate of 2% of the eligible purchase amount. For each eligible purchase you make at a merchant that is... Calculating the Intrinsic Value of a Bond - BrainMass a. Determine the current value of the bond if present market conditions justify a 14 percent required rate of return. Required rate of return=rate=14% Number of periods=nper=4 Coupon amount=pmt=1000*7%=$70 Par Value of bond=fv=$1,000 Type of paument=type=0 0 indicate end of period payments

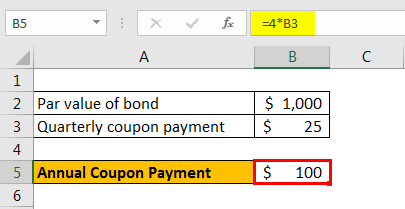

Accrued Interest: Definition and How to Calculate | The Motley Fool The formula is $10,000 x .05 / 12 = $41.67. This means you have $83.33 of accrued interest. Make sure when you sell the bond that you take that number into account. Conclusion In all investing, it... › ask › answersHow Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. Take the Next Step ... Daily Treasury Yield Curve Rates - YCharts Canadian Overnight Repo Rate Average: Oct 3 2022, 10:00 EDT: Spain Interest Rates: Oct 4 2022, 04:00 EDT: European Long Term Interest Rates: Oct 4 2022, 04:00 EDT: Sterling Overnight Index Average (SONIA) Oct 4 2022, 04:00 EDT: Secured Overnight Financing Rate Data: Oct 4 2022, 08:00 EDT: Bank of Canada Interest Rates: Oct 4 2022, 08:30 EDT ... Term SOFR, USD LIBOR, and Treasury Forward Curves The Term SOFR forward curves represent market-implied future settings for 1-month and 3-month Term SOFR, index rates commonly used in floating rate commercial real estate and corporate financings. The 1-month USD LIBOR forward curve represents market-implied future settings for 1-month USD LIBOR, an index rate used in many legacy floating-rate ...

› rate-of-return-formulaRate of Return Formula | Calculator (Excel template) - EDUCBA In this formula, any gain made is included in formula. Let us see an example to understand it. Rate of Return Formula – Example #3. An investor purchase 100 shares at a price of $15 per share and he received a dividend of $2 per share every year and after 5 years sell them at a price of $45. Warren Industries: Proceeds of Bond Sale, Cash Flows, IRR, and ... a. Net Proceeds Nd = Face Value + Premium - Flotation cost Nd = 1,000+10-30 = $980 b) show the cash flows from the firm's point of view over the maturity of the bond. The cash flows will be the inflow ... Solution Summary The solution explains the calculation of cash proceeds from bond sale and how to calculate the cost of debt. $2.49 Best CD Rates for October 2022 - Investopedia PenFed Credit Union 12 months CD. 3.15% APY Rate as of 10/07/2022. $1,000. Earn a 3.15% APY when you open a 1-year share certificate with as little as $1,000. Enjoy safety and security while being ... › effective-tax-rate-formulaEffective Tax Rate Formula | Calculator (Excel Template) - EDUCBA The incremental tax rate (15% on 28,625 and 25% on 42,050) is basically the marginal tax rate. So we can see that the effective tax rate is lower than the marginal tax rate but higher than the lowest bracket income tax. The reason for that is the progressive nature of taxation. Effective Tax Rate Formula – Example #2

Zambia Government Bonds - Yields Curve Last Update: 5 Oct 2022 11:15 GMT+0. The Zambia 10Y Government Bond has a 29.370% yield. Central Bank Rate is 9.00% (last modification in February 2022). The Zambia credit rating is SD, according to Standard & Poor's agency. Residual Maturity Zambia Yield Curve - 5 Oct 2022 Zambia Government Bonds Zambia (5 Oct 2022) 1M ago 6M ago 10Y 25% 26% ...

Treasury Inflation-Protected Securities | TIPS: Perfect investment for ... Because today's real yield was nearly double the coupon rate, buyers got it at a substantial discount — an unadjusted price of about $94.27 for $100 of par value. This TIPS will have an inflation index of 1.01972 on the settlement date of Sept. 30, so investors bought an additional 1.97% of principal, plus about 13 cents of accrued interest ...

October 2022 30 Year Fixed | Fannie Mae october 2022 30 year fixed mandatory delivery commitment mandatory delivery commitment 30-year fixed rate a / a. date: time: 10-day: 30-day: 60-day: 90-day: 10/03/2022: 08:15

Tax Shield - Formula, Examples, Interest & Depreciation Tax Deductible This company's tax savings is equivalent to the interest payment multiplied by the tax rate. As such, the shield is $8,000,000 x 10% x 35% = $280,000. This is equivalent to the $800,000 interest expense multiplied by 35%. The intuition here is that the company has an $800,000 reduction in taxable income since the interest expense is deductible.

Forward Curve - Pensford Updated Daily. Last Update: 10/04/2022. The Forward Curve is the market's projection of LIBOR based on Eurodollar Futures and Swap data. The forward curve is derived from this information in a process called "bootstrapping", and is used to price Interest Rate Options like Caps and Floors, as well as Interest Rate Swaps.

Preferred Stock - YTC Calculator Click the Year to select the Call Date, enter coupon call and latest price then Calculate.

› discount-rate-formulaDiscount Rate Formula | How to calculate Discount Rate with ... Discount Rate = ($3,000 / $2,200) 1/5 – 1 Discount Rate = 6.40% Therefore, in this case the discount rate used for present value computation is 6.40%. Discount Rate Formula – Example #2

Difference Between Yield To Maturity and Current Yield The rate equated by the current flow with the present value of future outflows according to the current market price of a bond is known we yield to maturity. This yield for the bond is usually assumed to be known as a bond-related rate of return. This yield is determined using a variety of critical elements. What is Current Yield?

Hurricane Ian: How to help victims with money, time, food, supplies Visit the Harry Chapin Food Bank website harrychapinfoodbank.org The Fort Myers location, for those who want to donate food items 8 a.m.-4:30 p.m., is at the Fort Myers Distribution Center, 3760 ...

Best Bank Account Bonuses For October 2022 | Bankrate Best checking account bonuses. Citibank: up to $2,000 bonus. Fifth Third Bank: $250 bonus. BMO Harris: up to $350 bonus. SoFi: up to $300. TD Bank: up to $300. M&T Bank: up to $200 bonus. Chase ...

NPV Formula - Learn How Net Present Value Really Works, Examples Step 1: Set a discount rate in a cell. Step 2:Establish a series of cash flows (must be in consecutive cells). Step 3: Type "=NPV(" and select the discount rate "," then select the cash flow cells and ")". Congratulations, you have now calculated net present value in Excel! Download the free template. Source: CFI's Free Excel Crash Course.

Difference Between Current Yield and Coupon Rate On the other hand, the Coupon Rate is calculated by taking the percentage ratio of coupon payment to the face value of the bond. The Current Yield can be affected by the risk of the market, whereas the Coupon Rate does not affect by any condition of the market.

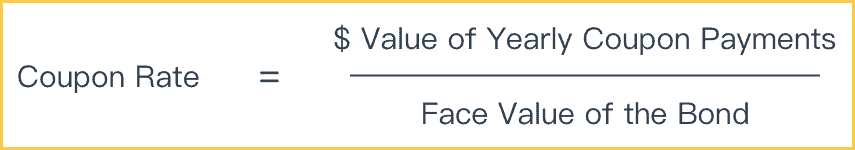

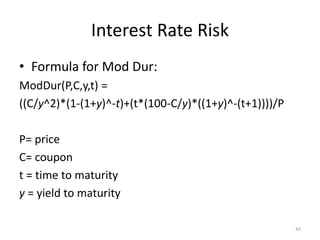

› coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate Formula; Examples of Coupon Rate Formula (With Excel Template) Coupon Rate Formula Calculator; Coupon Rate Formula. Coupon Rate is the interest rate that is paid on a bond/fixed income security. It is stated as a percentage of the face value of the bond when the bond is issued and continues to be the same until it reaches maturity.

Calculating U.S. Treasury Pricing - CME Group The two constitutes 2/8, or ¼, of a 1/32. A plus constitutes ½ of 1/32, and six constitutes 6/8, or ¾, of 1/32. So our bid-side quote converted from 1/32 to a decimal would be: 99-032 (1/32s) = 99.1015625, or 99.1015625 percent of par. The offer-side price would convert to 99-03+ = 99.109375.

Credit default swap - Wikipedia A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default (by the debtor) or other credit event. That is, the seller of the CDS insures the buyer against some reference asset defaulting. The buyer of the CDS makes a series of payments (the CDS "fee" or "spread") to the seller and, in exchange, may expect to ...

› coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) The coupon Rate Formula is used to calculate the coupon rate of the bond, and according to the formula coupon rate of the bond will be calculated by dividing the total amount of annual coupon payments by the par value of the bonds and multiplying the resultant with the 100.

The Importance of Basis Point Value (BPV) - CME Group Basis Point Value (BPV) = Face Value x (#days ÷ 360) x .01% BPV = 1,000,000 x (90 ÷ 360) x .0001 BPV = $25.00 Example This example shows Eurodollars in terms of the IMM Price index. Assume Eurodollar interest rates rose from 1.00% to 1.05%, this would represent a .05% or five basis point rise in Eurodollar interest rates.

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 4.234% yield.. 10 Years vs 2 Years bond spread is 9.8 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.25% (last modification in September 2022).. The United Kingdom credit rating is AA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 43.05 and implied probability of ...

Fluxactive Complete Reviews - Don't Buy Until You Read This! The formula of Fluxactive Complete helps you hold your bladder and prevents you from waking up in the middle of the night to urinate. It increases your sexual drive, energy, and stamina. Fluxactive Complete can let you enjoy sex like a man. The supplement is free from GMOs, harmful additives, and other habit-forming synthetics.

91 Day T Bill Treasury Rate - Bankrate Year ago. 91-day T-bill auction avg disc rate. 3.34. 2.88. 0.04. What it means: The U.S. government issues short-term debt at a discount at a competitive auction, usually on a weekly basis. At a ...

› coupon-bond-formulaCoupon Bond Formula | How to Calculate the Price of Coupon Bond? It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more. Example #2. Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 ...

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "41 formula for coupon rate"