38 ytm for coupon bond

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ The Bond Yield to Maturity Calculator computes YTM using duration, coupon, and price. The approximate and exact yield to maturity formula are inside. ... and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600; Par ... How to calculate YTM in Excel | Basic Excel Tutorial Face value =1000 Annual coupon rate =10% Years to maturity =10 Bond price =887. Now let us create the YTM using these values. 1. Launch the Microsoft Excel program on your computer. 2. Write the following words from cells A2 -A5. Future Value, Annual Coupon rate, Years to maturity, and Bond Price. 3.

How to calculate yield to maturity in Excel (Free Excel Template) RATE (nper, pmt, pv, [fv], [type], [guess]) Here, Nper = Total number of periods of the bond maturity. The years to maturity of the bond is 5 years. But coupons per year are 2. So, nper is 5 x 2 = 10. Pmt = The payment made in every period. It cannot change over the life of the bond. The coupon rate is 6%.

Ytm for coupon bond

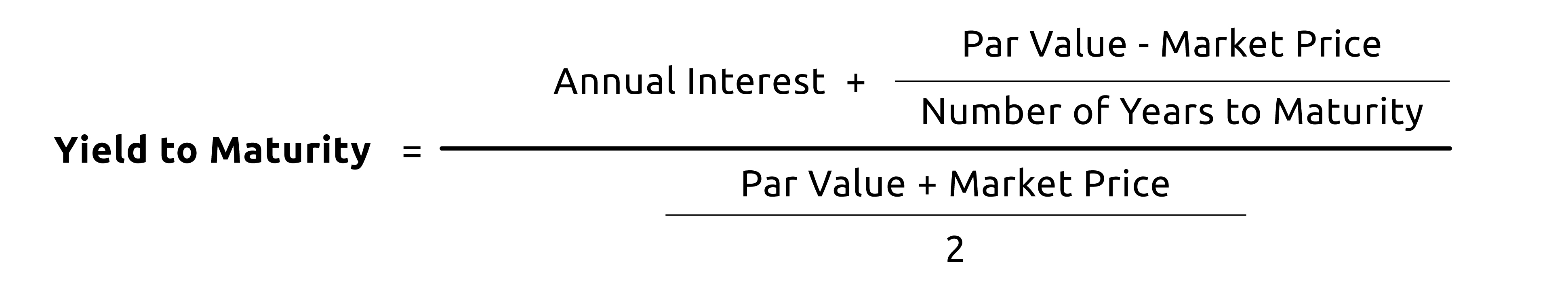

› calculator › bond_yield_calculatorBond Yield Calculator - Moneychimp Coupon Rate: % Years to Maturity: ... Current Yield: % Yield to Maturity: % Bond Yield Formulas See How Finance Works for the formulas for bond yield to maturity and ... Yield to Maturity (YTM) - Definition, Formula, Calculations Annual YTM will be - Therefore, the annual Yield on maturity shall be 4.43% * 2, which shall be 8.86%. Option 2 Coupon on the bond will be $1,000 * 8.50% / 2 which is $42.5, since this pays semi-annually. Yield to Maturity (Approx) = (42.50 + (1000 - 988) / (10 * 2))/ ( ( 1000 +988 )/2) › bond-yield-formulaBond Yield Formula | Step by Step Calculation & Examples Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we have to understand that this calculation completely depends on annual coupon and bond price.

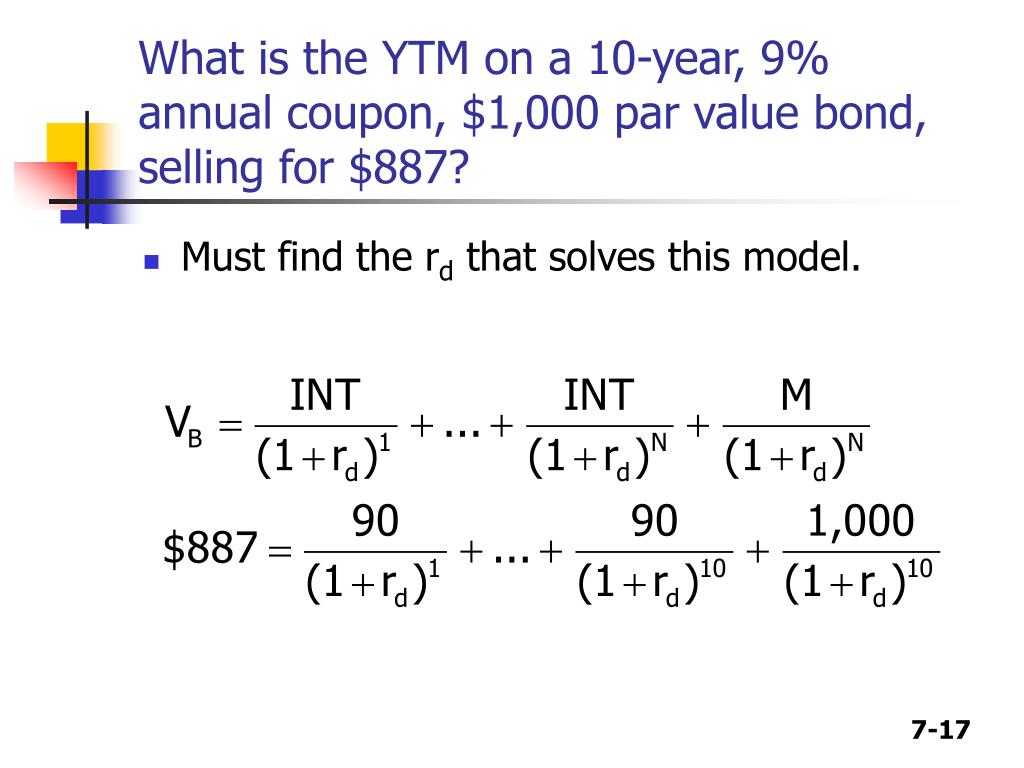

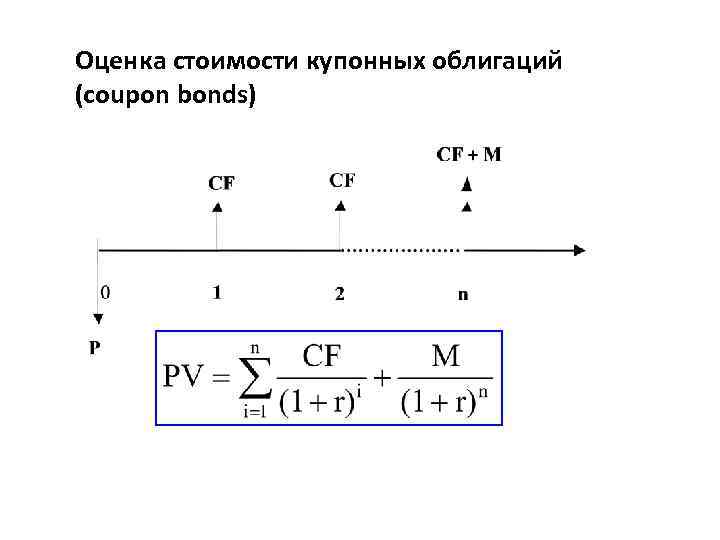

Ytm for coupon bond. The Returns on a Bond - YTM - The Fixed Income The bond price is calculated from the yield to maturity of the bond, as that is the effective return on the bond. The formula, YTM = C1/ (1+YTM)^1 + C2/ (1+YTM)^2 + C3/ (1+YTM)^3 + ……+ Cn/ (1+YTM)^n + Maturity value/ (1+YTM)^n Here 'C' is the coupon or each installment of interest received, › bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. Yield to Maturity (YTM) Definition & Example | InvestingAnswers The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we'll use the formula mentioned above: YTM = t√$1,500/$1,000 - 1 The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate. How to Calculate the Price of Coupon Bond? - WallStreetMojo = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

Zero Coupon Bond Yield Calculator - YTM of a discount bond This calculator can be used to calculate the effective annual yield or yield to maturity (YTM) of investment in such bond when the bond is held till maturity. Purchase Price of Bond. Face Value / Maturity Value of Bond. Bond Purchase Date (DD/MM/YYYY) Bond Maturity Date (DD/MM/YYYY) % p.a. Note: The yield calculated by this calculator is Excel ... Calculate the YTM of a Coupon Bond - YouTube Michael Padhi. This video explains the meaning of the yield to maturity (YTM) of a coupon bond in the coupon bond valuation formula and how to calculate the YTM using a financial calculator. Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... Relationship with bond's price A bond's price moves inversely with its YTM. An increase in YTM decreases the price and a decrease in YTM increases the price of a bond. The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Calculate YTM on deferred coupon bonds using texas instruments Stellar Corp. recently issued $100 par value deferred coupon bonds, which will make no coupon payments in the next four years. Regular annual coupon payments at a rate of 8% will then be made until the bonds mature at the end of 10 years. If the bonds are currently priced at $87.00, their yield to maturity is closest to: 6% = Answer

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. 1 It is the sum of all of its remaining coupon payments.... Coupon Rate Calculator | Bond Coupon When the bond is issued, the coupon payment per period and coupon frequency will be stated on the bond indenture. The annual coupon payment is the product of the two, as seen in the formula below: annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate Yield to Maturity (YTM) - Overview, Formula, and Importance Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security, such as a bond. The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value), and that all interest and coupon payments are made in a timely fashion.

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments r = discount rate (the yield to maturity) F = Face value of the bond n = number of coupon payments

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula. Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1; Zero-Coupon Bond Risks

› terms › yYield to Maturity (YTM) Definition - Investopedia Nov 11, 2021 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

What is YTM in bonds? Let's say, you bought a Bond at a discount of Rs50 from its face value of Rs 1000 then your buying price will turn out to be Rs 950. If the Bond has a coupon rate of 9% and 1 year to maturity then the YTM will be as follows-. Yield%=Interest received/Bond purchase price. Interest received =90. Purchase price= 950.

Coupon Rate - Meaning, Calculation and Importance - Scripbox This article explains the coupon rate for bonds, its calculation, importance and difference between coupon rate and yield to maturity in detail. ... Purchase Price of a Bond: Coupon Rate: Yield to Maturity (YTM) Face Value: 15%: 15%: Higher than the face value (at a premium) 15%: Lower than the coupon rate:

Yield to Maturity Calculator | Calculate YTM The YTM can be thought of as the rate of return on a bond. If you hold the bond to maturity after buying it in the market and are able to reinvest the coupons at the YTM, the YTM will be the internal rate of return (IRR) of your bond investments.

How to Perform Bond Valuation with Python | by Bee Guan Teo | Towards ... The YTM of the bond is about 7.89%. Since the bond coupon rate (5%) is less than its YTM, the bond is selling at a discount. On another hand, if the coupon rate is more than its YTM, the bond is selling at a premium. YTM is useful for an investor to determine if a bond is purchased with a good deal.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Yield to Maturity (YTM) - Meaning, Formula & Calculation Below is the YTM formula Where, bond price = the current price of the bond. Coupon = Multiple interests received during the investment horizon. These are reinvested back at a constant rate. Face value = The price of the bond set by the issuer. YTM = the discount rate at which all the present value of bond future cash flows equals its current price.

fixed income - Calculating YTM for a floating rate bond - Quantitative ... 1. The yield is the internal rate of return of the coupons and the principal repayment. For a floater, the future unset coupons are not known, and the value of the yield depends a lot on how you project them, making the yield less stable than DM. On Bloomberg terminal, for example, there is a setting for how to project a floater's coupons.

› yield-to-maturity-ytmYield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price. Yield to Maturity (YTM) Formula

› bond-yield-formulaBond Yield Formula | Step by Step Calculation & Examples Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we have to understand that this calculation completely depends on annual coupon and bond price.

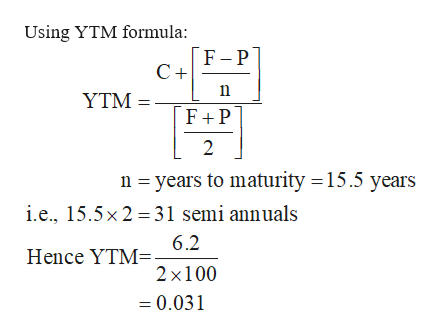

Yield to Maturity (YTM) - Definition, Formula, Calculations Annual YTM will be - Therefore, the annual Yield on maturity shall be 4.43% * 2, which shall be 8.86%. Option 2 Coupon on the bond will be $1,000 * 8.50% / 2 which is $42.5, since this pays semi-annually. Yield to Maturity (Approx) = (42.50 + (1000 - 988) / (10 * 2))/ ( ( 1000 +988 )/2)

› calculator › bond_yield_calculatorBond Yield Calculator - Moneychimp Coupon Rate: % Years to Maturity: ... Current Yield: % Yield to Maturity: % Bond Yield Formulas See How Finance Works for the formulas for bond yield to maturity and ...

Post a Comment for "38 ytm for coupon bond"